The bucket approach to retirement planning gives you access to money for expenses but the upside potential to grow your investments

Retirees used to rely on what was called the three-legged stool idea for retirement planning. Most people could rely on money from social security, a pension fund and their own individual retirement savings as three key supports for holding them up in retirement.

With the collapse of the pension system and the inevitable demise of social security, it’s becoming increasingly likely that most people will be balancing on just one-leg of that stool.

To address the problem, financial advisors have come up with the bucket approach to retirement planning. The bucket system is a great way to separate and manage your retirement investments to provide safety for expenses while still enjoying the upside potential to grow your investments.

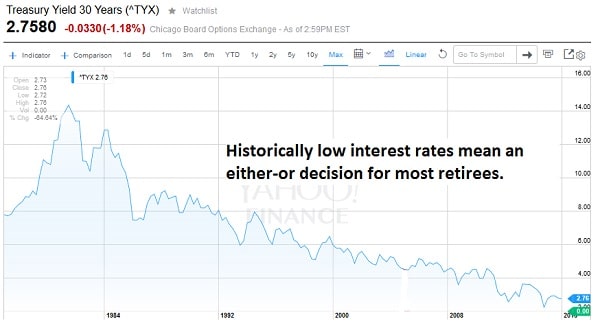

The Bucket Approach to Retirement Planning is not an Either/Or Decision

A retiree in the 80s could put their money in Treasury bonds or ultra-safe corporate bonds and glide through retirement on a stream of coupon payments. The rate on the 30-year Treasury Bond exceeded 14% in 1981 and corporate bond rates approached payouts of 20% or more. Inflation ate away at your payments but annual price increases came under control by the early 90s and bond prices kept rising on lower interest rates.

My how times have changed. The 30-year Treasury pays a yield of just 2.75% a year to lock your money up for three decades. Low rates on bonds have led to a dangerous either-or situation for investors planning their retirement.

You can keep your money in the safety of fixed-income, with rates on investment grade bonds providing about 2% return after inflation. At this rate, your retirement accounts amount to little more than a savings account and with healthcare costs rising faster than general inflation, it isn’t really an option for most retirees.

Many retirees have opted for the alternative, taking on more risk for a higher return. Investors have piled into junk bonds, dividend stocks and other risky investments to gamble on their retirement goals. Anyone planning their retirement during 2008 could tell you the problem with this strategy. Stocks in the S&P 500 lost 1% annually over the 10 years to 2010. That’s a decade of losing money in stocks.

It’s clear that this either-or approach isn’t going to work for retirement planning going forward, especially without the benefit of social security or the pension system to fall back on.

Enter the bucket approach to retirement planning.

The bucket approach calls for three distinct groups of investments through retirement. Your first bucket is for cash investments like very short-term bonds. These investments won’t provide much of a return but will provide for your current expenses.

In your second bucket of investments, you place 5- to 10-year bonds and income producing stocks. This bucket is designed to produce cash which will be used to refill your cash bucket, more on this later. You still want to invest in safe investments like investment-grade bonds and dividend stocks of very large companies.

Your final bucket is composed of stocks and high-yield bonds for capital appreciation potential. These investments may not produce much cash through dividends but the value of the bucket should grow over the years.

You’ll want to hold some precious metals exposure like gold and silver within both your cash bucket and the capital appreciation bucket. Gold and silver are highly liquid which will give you quick access to cash if you need it but they also hold strong long-term price potential, giving your third bucket the growth it needs. All of these investments can be held in an IRA or 401k investments.

How to Maintain a Bucket Approach Retirement

Only using the cash produced from your second bucket to refill the cash bucket should mean that the value stays pretty consistent. Try keeping around three to five years of expenses in your second bucket. This will produce enough cash to refill the first bucket but also a safety net to cover a few years of weak stock prices.

During years when the stock market does well, you’ll also use the added value on your third bucket to refill the other two buckets. If stocks jump 10%+ in a year, you’ll be looking at a much higher value in your capital appreciation bucket. Put some of this money into your second bucket so you’re producing more cash each year. If you keep enough money in your first and second buckets to cover a few years of expenses, you won’t have to touch your third bucket when the stock market falls. You’ll be able to wait out the time until your third bucket refills itself through higher stock market gains.

This bucket approach to retirement planning provides the best of both worlds, safety in cash and bonds with the potential for higher returns on stocks. Managed correctly and you won’t have to worry about running out of money due to low rates or high-risk investments.