When you sign up for a 401k through your employer, you will be given a list of different investment options. Some companies offer only one plan with the opportunity to have more conservative or aggressive options. Other companies offer the option to choose from more than one investment company or plan. Some companies even give you the opportunity to choose a self-directed 401k, which allows you even more options than a traditional plan.

What Is a Self-Directed 401k Rollover?

A self-directed 401k lets you choose from a wide number of investments. You have the option to choose single stocks, and a wide range of investments. When you invest in a self-directed 401k, it is similar to having your own brokerage account under the tax protection of the 401k plan. This can be a good option if you are comfortable making your own investment choices.

Pros:

Self-directed 401k plans offer a wide array of investment options including property, gold, and individual stocks.

You have complete control over your investments. You can choose the types of mutual funds or individual stocks, and the companies you choose to invest through.

You can have the opportunity to respond to the market in the way that you want. You can be as aggressive or conservative as you want to be.

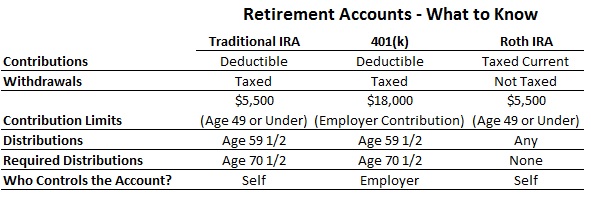

You are allowed to invest more in a 401k each year than an IRA, which means you should take advantage of this and any potential employer’s match to your contributions.

Cons:

According to Fox Business, the fees associated with the account may be one of the biggest cons. You can have an annual maintenance fee, as well as transaction fees associated with the account. High fees are one of the biggest reasons some investors look into self-directed 401k rollovers.

Managing your own account can be time consuming. It is important to be able to respond to market conditions quickly.

There are a number of rules about allowed and banned investments, and you need to be sure you stay in compliance with them.

Understanding Self-Directed 401k Rollovers

Types of Investments in a Self-Directed 401k Rollover

A self-directed IRA will broaden the types of IRA investments that you can have in your 401k. Most 401k plans give you a limited number of 401ks to choose from when you are investing. This limits your choices, and ultimately takes away some of the control that you could have over your retirement accounts. There are a wide variety of options within the self-directed 401k.

Mutual Funds: You have the option to invest in mutual funds with your self-directed 401k. The benefit of choosing a self-directed over the traditional option is that you get choose the mutual funds. You can find funds that out per form the funds that are currently offered in your company’s 401k.

Individual Stocks: If you like to invest in individual stocks, you can do it inside of this account. However, you need to pay close attention to the market, and monitor the companies that you include. You should never only own one type or one company’s individual stock. You need to spread the risk around.

Precious Metals: You have the opportunity to purchase from an approved list of precious metals. This includes certain gold and silver coins.

Property: You can purchase property as part of your investment. This needs to be investment property and cannot be your primary residence or even a vacation home.

Rules you MUST follow in Self-Directed 401k Rollovers

The rules of a self-directed 401K basically limit the types of items you can purchase and the types of transactions you are allowed to complete. For example, you are not allowed to complete any transactions with yourself or family members. You are not allowed to purchase collectibles like works of art with the 401k, and you cannot live in or use the properties that you own as investments. This is where self-directed 401k rollovers come into play.

Why Rollover your 401k into an IRA?

A self-directed IRA gives you even more control over your retirement savings. One of the ways is that you can choose the company that oversees it, and you can look for a company with lower maintenance and transfer or purchase fees than what is currently offered by your employer.

You may also want to rollover into an IRA because it is easier to manage all of your retirement savings in one location. This can make it easier to make sure you have balanced your investment correctly. If you are managing multiple accounts, you may become confused at what investments are in each account. Consolidating them into an IRA just makes the entire process easier for you.

Eligibility for Self-Directed 401k Rollovers

Not everyone is eligible to execute self-directed 401k rollovers. If you are currently working with the employer that offered you the self-directed 401k, you will not be eligible to roll it into an IRA. You can only roll over 401ks from past employers. Many people choose to rollover their 401ks because it makes it easier to manage all of the retirement funds in just one place.

Completing the 401k Rollover Process

In order to rollover your 401k, you will need to contact the human resources representative at your old company to find out who the plan’s administrator is. Then you will need to complete the paper work to pull the money out. You have sixty days from the time the money is issued to you to deposit it into an eligible IRA account.

When you open an IRA, you can choose to open your IRA at three different types of places. The type of IRA you want will determine where you open your IRA.

You can open your IRA at a bank or credit union. These funds will be in a Certificate of Deposit. The FDIC guarantees these funds up to $250,000. However, they have the lowest rates of growth.

Investment firms will allow you to open an IRA and roll your 401k into it. The investment firms will allow you to choose among several different mutual funds. This type of account is the closest to a traditional 401k account.

You can also choose a self-directed IRA, which works similarly to a self-directed 401k. You can choose the same types of investments and will need to follow the same rules when it comes to the eligible transactions you can complete.

You can also choose between a traditional and Roth IRA. The easiest 401k rollover process is go straight from a traditional 401k to a traditional IRA, or from a Roth 401k to a Roth IRA. If you switch from a traditional 401k to a Roth IRA, you will need to be prepared to pay taxes on the amount that you rollover.

Avoiding Taxes and Penalties on Self-Directed 401k Rollovers

The best way to avoid taxes and early 401k withdrawal penalties is to complete the rollover within sixty days. If you do this, you will not face any penalties or taxes. If you miss the deadline, you will owe a ten percent penalty as well as owe taxes on the amount that you withdrew. If you pay the taxes on a traditional to a Roth conversion from your 401k, you will need to pay the penalty on that money. Be sure to talk to a tax professional about this if you end up owing a penalty or taxes.

If you are ready to roll your self directed 401k into a self directed IRA, you can call 1-800-776-7253 to find a professional in your area to answer any questions about the process and to help you find the right options for you.