Prepare your retirement for these what-if scenarios in America’s future to ensure the retirement you deserve

I am not generally a doom and gloom kind of guy when it comes to retirement planning and America’s future. Against the perennial calls for some kind of catastrophic end to life as we know it, the future seems to become the past with little to change my rational perspective.

There’s always the possibility that one of the storm clouds on America’s horizon could turn into a full-blown tempest. More often than not, the future tends to look like the past.

The problem with this optimistic outlook on retirement is that it doesn’t account for the pain that occurs if something does happen. There may be only a small chance that a financial catastrophe happens but it could completely wipe out your retirement savings and leave you destitute in what should have been your best years.

Even on the off chance that the worst of the worst scenarios in America’s future come to light, preparing your retirement plan can help you avoid the fallout.

3 Things that Could Go Horribly Wrong in America

1) A Productivity Crisis in America

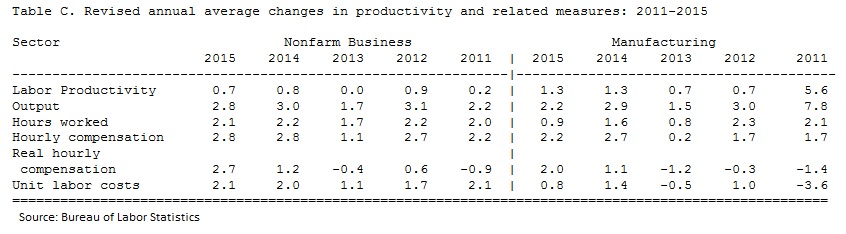

The first scenario is actually one that has a very good chance of coming to pass and could be worse than anyone is predicting. Productivity growth, how much each worker produces, has fallen to less than one percent over the last five years. That’s well below the 2.1% average for the three decades before 2007 and a far cry from America’s golden age of 2.8% productivity growth from 1947 through 1973.

In fact, productivity growth over the last five years has been the lowest in recorded history.

Productivity growth is closely linked to growth in wages and standard of living. If America’s workforce is not producing more goods and services per worker, wages stagnate (as they have done for the last several years) and inflation eats away at what you can buy. Since more than two-thirds of our economy is driven by consumer spending, the drop in wage growth flows through to historically low economic growth.

We actually know what is causing the drop in productivity growth. It’s poor policy decisions around corporate taxes, trade policy and education. I would like to think that the government can address these issues but I’m not leaving my retirement to chance.

Now combine low productivity of workers with the fact that 10,000 people are reaching retirement age every day through 2030 and you’ve got a real problem. Fewer workers producing at a slower pace means economic growth could fall to almost nothing. Investments that should hold up well include precious metals which will retain their value when the greenback crumbles and some healthcare companies which will continue to benefit on the aging of the country.

2) A Cyber-Attack Wipes Out Financial Records

Up to the last few years, cyber-attacks were something that happened to other people. This is changing as we all become virtually connected and 61% of cyber experts agree that there will be a major attack causing widespread harm by 2025, according to a Pew Internet Survey.

Cyber-warfare has become the preferred weapon of governments because they can cause irreversible damage while still claiming that independent groups were to blame. A major attack would go well beyond one company’s loss of credit card information as happened at Target in 2013. A major attack could wipe out financial records of huge sections of the population, setting us all back to zero.

Most critical financial data is backed up on multiple servers but what’s to stop the hackers from targeting those records as well. Besides real assets like precious metals, investors should protect themselves with other assets that can be physically-held like real estate and collectibles.

3) Massive Municipal Defaults Reach Far Beyond Detroit

The Federal Reserve has created the problem with three decades of lower rates. Interest rate manipulation has made it easier for local governments to fund their wasteful programs with more debt, constantly taking out new loans to cover old loans and new projects.

Rates hit a bottom over the last few years and are starting to rise, putting state and local municipalities against the wall. They can’t afford new debt at higher rates and slow economic growth means they can’t pay off the debt that’s coming due. Puerto Rico has been able to keep creditors at bay on its $72 billion in debt but it won’t be long before it and many others start to default en masse.

The wave of municipal defaults will rock the financial system because many of the pension funds and insurance companies on which we rely are heavily invested in municipal bonds. When those bonds default, tens of millions of pensions will be wiped out and insurance policies will become worthless. The best defense is to take control of your own retirement assets with a 401K rollover into an individual retirement account (IRA). You’ll have greater flexibility in your investments and better control of where your money is used.

These three scenarios are not the only ones that could occur, wiping out America’s economic future and your hope for the retirement you deserve. While a catastrophic crisis is still a lower-odds event, it pays to prepare by positioning your IRA investments for these what-if ideas.