Use this quick guide to find the safest retirement investments by age and get your retirement planning back on track

The S&P 500 index of stocks is off it’s 52-week high by 13%, well into a correction but not the 20% needed to call it an end to the seven-year bull market. The drop in prices couldn’t come at a worse time for more than 10,000 Americans that will reach retirement age this year.

For them, sleepless nights may be coming along with flashbacks of the Great Recession and a 57% market plunge in 2008.

Retirement planning isn’t just about earning a return on your investments, it’s about holding the right investments depending on how long you’ve got to retirement. Planned correctly and you’ll move progressively closer to your goals with less risk. Done incorrectly and Mr. Market could put your retirement on hold…indefinitely.

We looked at some of the best investments for your 401k money and the general idea around asset allocation last week. We’ll detail the idea this week with how to plan your portfolio around the safest retirement investments according to the time you have left to retirement.

Asset Allocation and Retirement Planning

The idea of asset allocation for retirement planning revolves around the risk-return tradeoff in each asset class and your time horizon to retirement. While stocks have dropped 20% into a bear market seven times in the last 50 years, they have always rebounded and have provided nearly a 9% annual return over the period. Ten-year Treasury Bonds, the risk-free investment, haven’t suffered the same volatility buy have only returned about 6% annually over the period.

Investors with the time to wait out bear markets have been rewarded. Unfortunately, while patience may be a virtue, you might not always be able to wait for a market rebound. It took seven years for the stock market to retake its previous levels after the bear markets in 1973 and 2000. Even relatively moderate selloffs have taken around four years for stocks to bounce back.

Have too much of your retirement investments in stocks before you retire and you could be withdrawing money at exactly the wrong time. Not only will your nest egg have lost much of its value but you’ll never get the chance to profit from an eventual rebound.

Retirement Investments for 20 Years to Retirement

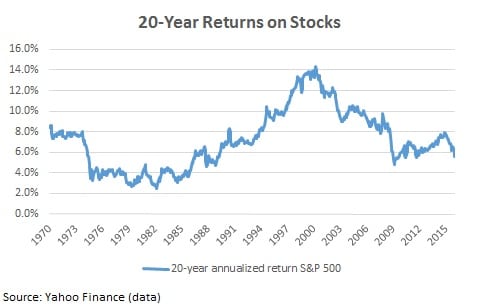

If you’ve got 20 years or more to retirement, safety investments can take a back seat to making more on your money. The minimum annual return on stocks over any 20-year period going back to 1950 has been 2.5% with a maximum annualized return of 14.4% over the period. While getting an annual return of just 2.5% over 20 years would make it tough to meet your retirement goals, stocks are almost certain to provide a positive return over this very long time period.

The overall percentage of stocks in your retirement portfolio will also depend on your risk tolerance but investors with two decades or more to retirement should be able to handle up to 60% of their account in stocks. Equities provide higher upside potential than most other retirement investments and a partial hedge against inflation.

Legendary investor Jack Bogle recently forecast below-average returns of 6% on stocks and 3% on bonds over the next decade as weak global and low interest rates hit investments. Several factors may come together over the next decade to increase uncertainty and risk in these two traditional investments. Besides a large percentage in stocks, investors may want to hold up to 25% of their portfolio in gold and other precious metals as a hedge against increased volatility in the markets.

With more than 20 years to retirement, you are likely to need very little of your portfolio in bonds. Fixed income investments provide no protection against inflation and will under-perform other retirement investments over very long periods.

Retirement Investments for 10 Years to Retirement

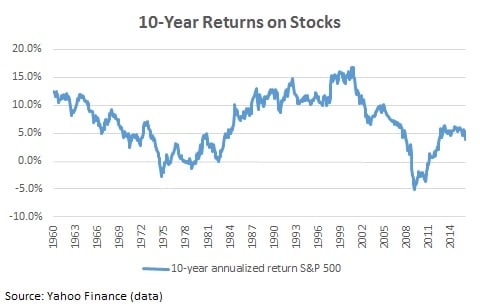

Reaching within a decade of your planned retirement means getting more cautious with your investments. The minimum annual return on stocks over any 10-year period going back to 1950 has been a loss of 5.1% with a maximum annualized return of 16.8% over the period.

You read that right. Investors in February 2009 had lost 5% a year on stocks over the preceding decade.

For investors within a decade of retiring, you may want to cut your investment in stocks to 50% or less. You may still need some growth potential to meet retirement goals and protection against inflation but you can’t afford to take too much risk at this point.

Precious metals and other hard assets like real estate should make up a larger proportion of your retirement investments, upwards of 35% or more. These real assets offer the ultimate protection against inflation and can provide upside return as well.

While bonds will not offer much return, you will also want to increase your holding of fixed income investments as you head the decade before your planned retirement date. Most investors should still limit their portfolio to about 35% or less in bonds, in favor of real assets that can provide inflation protection.

Retirement Investments for Pre-retirement

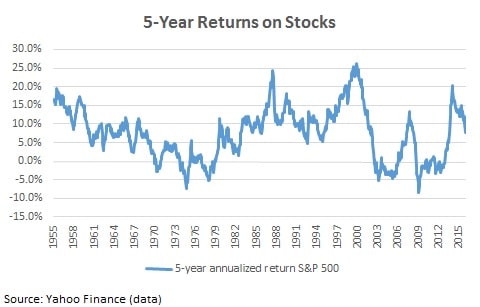

Within just a few years of your retirement, you should be positioning in only the safest retirement investments. The minimum annual return on stocks over any 5-year period going back to 1950 has been a loss of 8.5% with a maximum annualized return of 26.2% over the period.

Take a closer look at the chart below. It isn’t uncommon for stocks to post a loss for more than five years.

Even with just a few years to retirement or within retirement, you don’t want to cut stocks completely out of your retirement investments. Your spending in retirement changes as you age, decreasing by as much as 35% in your 80s, so you won’t need to spend all your retirement money right away. You’ll need some money in stocks, up to 25% of your retirement portfolio, to provide some kind of growth to avoid running out of funds.

Safety and protection is the name of the game in your pre-retirement investments and few investments offer those characteristics like gold. An investment in precious metals will also help to stabilize the returns you see on stocks, since gold prices tend to do well during times of market volatility and falling stock prices.

Your investment in bonds will likely be relatively large in this last period, just before and during retirement. While you still need some protection against inflation, best provided with gold and precious metals, you need a constant stream of income and the relative certainty of fixed income. Consider making bonds up to half or more of your retirement portfolio.

Within all three portfolios and the safest retirement investments, gold and precious metals are a constant. Stocks offer the potential for returns but have also lost money for up to ten years at a time. Bonds offer some certainty but no protection against inflation and historically low rates won’t get you to your retirement goals. Holding gold within your IRA investment options is one of the only ways to ensure you reach your financial destination with the safety and asset protection you need.