This survey sheds new light on how your retirement spending will change and makes it easier to meet retirement goals

Too many people fumble into retirement planning with goals based on their current expenses. They end up terribly ill-prepared and miss their retirement goals because of assumptions on retirement spending that just don’t pan out. A survey by the Employee Benefit Research Institute (EBRI) found some surprising facts about how retirement spending changes as we age and could help you reach your retirement goals.

How Does Retirement Spending Change with Age?

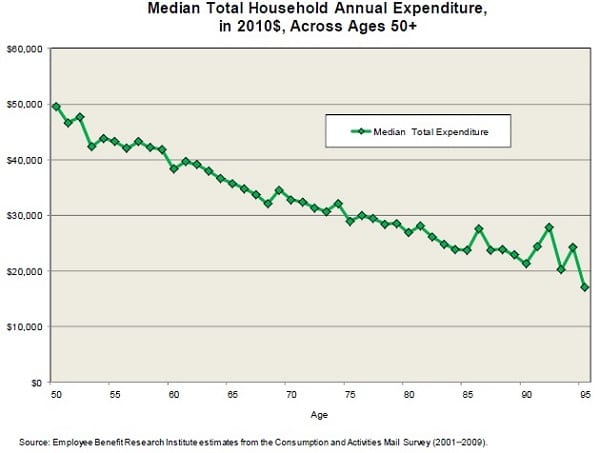

The most important general idea from the retirement spending survey is that your spending will likely gradually decline as you age. Using retirement spending patterns at age 65 as a benchmark, the study found that spending fell by 19% on average by the time the retiree reached 75 years old. Retirement spending fell 34% by 85 and was just half of pre-retirement spending by the time the person reached 95 years old.

Retirement Spending by Age

Not only did retirement spending fall with age but the decrease was pretty much a straight line over the years. Retirees expecting their spending to drop quickly after retirement may be disappointed and end up spending down their retirement account investments faster than they anticipated.

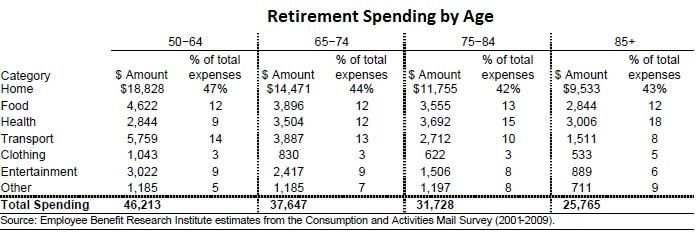

Home and home-related expenses were nearly half of retirement spending for most people, accounting for about 40% of total spending. It’s not surprising that healthcare expenses were the second largest item and was the only retirement spending component to increase with age. Spending on healthcare is around 10% of retirement spending at age 65 and increases to just over 20% for those 85 and older.

Spending on food remained a fairly consistent percentage of total spending though the amount spent decreased with age. Spending on transportation stayed consistent until dropping quickly after 75 years old.

Two-thirds of the population (65.9%) sees a drop in spending immediately after retirement. This is important in the fact that a third actually saw their retirement spending increase. This group probably traveled and worked through other life goals immediately after retiring, causing their spending to go up. Even for this group, their retirement spending decreased after a few years but it is important to understand what you want to do in retirement. If you plan on doing things outside your current routine, like traveling, then you may need to budget for higher expenses in your first few years of retirement.

Problems with Retirement Spending and Planning

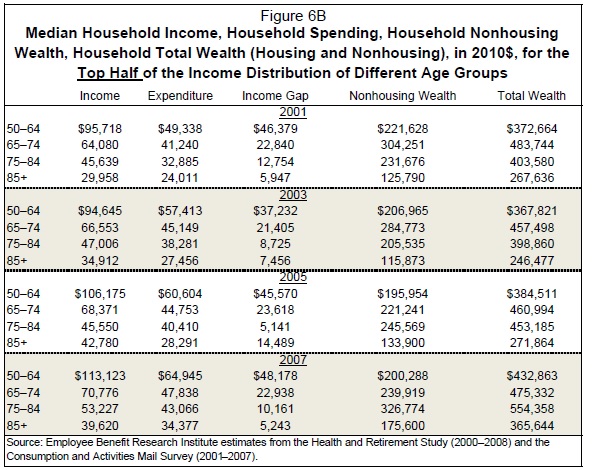

One disturbing trend is buried about half-way through the survey and not picked up by the researchers. The table below shows the income gap and total wealth for the top half of the respondents by income. Take a look at the income gap in the table.

Do you see the problem? Even among the wealthiest 50% of the population, income decreases rapidly through retirement while retirement spending decreases but not as fast. In 2001 and 2007, retirees 85 years and older were barely able to cover their annual expenses. This includes Social Security benefits and is likely to get worse as the government cuts benefits and the stock market fails to meet expectations for returns.

The problem many run into with their retirement spending has to do with an over-reliance on benefits like social security and Medicare. The average Social Security benefit is less than $1,350 a month, far less than is needed to pay the bills. Medicare coverage is not comprehensive. It caps the number of days covered during a nursing home stay and does not include many long-term care costs. This makes it extremely important to plan out your investment goals without relying too much on government assistance or benefits.

Retirement Spending Survey: Conclusions

The outcome of the retirement spending survey is fairly clear, the old myth of estimating that you’ll need 80% of your current income for retirement spending is an oversimplification. While retirees 80 years and older may spend less, you will likely spend much more than 80% of your pre-retirement spending for several years. In fact, people in the survey didn’t get down to the 80% market on average until ten years into retirement.

Some retirees will even see their expenses increase in retirement as they travel more and check off things on their bucket list. Even the top income earners saw their income decrease more quickly than their expenses, making their later years increasingly anxious that they’ll be able to meet their needs.

Retirement planning must be done on a personal level, understanding your own goals and needs as you age. Once you better understand potential expenses in retirement, you can start customizing your portfolio of 401k investments and how to best plan for the future.