Avoid the critical flaw in 401K plan investments and put your 401K back on track

More than $21 trillion is invested in 401K plan investments across the United States with tens of millions of American workers relying on their plans for retirement. Besides the money invested in employer-sponsored 401K plans, you probably have investments in a regular investment account and individual retirement accounts.

While putting money away for your retirement is critical to meeting your financial goals, most people are wasting the investments in their 401K accounts and plan advisors know it and aren’t saying anything.

Why you’re investing wrong in your 401k

The problem is that your 401K plan investments are most likely completely segregated from the rest of your wealth and investment portfolio.

Think about how you set up your 401K plan at work. You probably met with a plan advisor, maybe even a couple of advisors from different approved fund providers. Hopefully you chose the 401K plan advisor with lower fees and sat down for a consultation. The advisor looked at your age and retirement goals and then suggested a few funds in which to regularly invest part of your paycheck.

…and that’s where it ended. You’ve been contributing to the same funds in your 401K plan for years and haven’t really thought much about your investment choices.

Besides pushing you into some of the funds with the highest commissions for the advisor, there’s one more critical fact that the advisor neglected to mention while setting up your plan contributions.

If you’re not building your fund contributions around your other assets and investments, you’re wasting your 401K plan.

Contributing to your 401K plan investments with no consideration to how it fits with your overall investments is likely over-allocating to some assets and missing out on the upside in others. Your plan advisor knows this but doesn’t really care as long as he can get you into those high-commission funds.

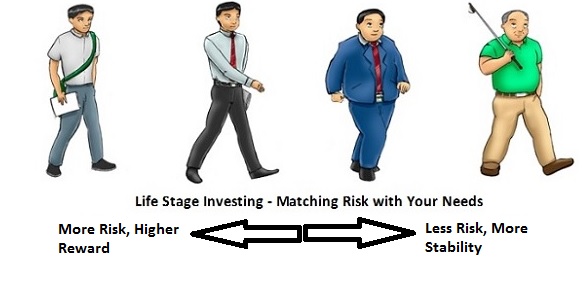

The way most advisors set up employee 401K plans is based on their age and a very fleeting look at the investor’s risk tolerance. Younger investors end up getting pushed into mostly stock funds while older investors fill their 401K plans with bonds. The plan might not be completely misguided by itself but misses the opportunity to diversify the investor’s total wealth and reach their investment goals with as little risk possible.

How to Get Your 401k Plan Investments Back on Track

First, note how much you have invested in each asset class. This includes stocks, bonds, real estate and alternative assets like private equity and hedge funds. Don’t forget to include your direct investments in real estate property. If you hold any exchange traded funds or mutual funds in bonds, include them in your fixed-income allocation even though the investment might trade like a stock investment. The same goes for real estate investment trusts (REITs) with real estate.

Once you’ve got your total investment in each asset class listed, go through each to note how much you have in the individual sectors (i.e. consumer staples, consumer discretionary, energy, financials, materials, technology, utilities and healthcare). This is an important step that many investors don’t realize could make a seemingly safe portfolio extremely risky. For example, even an all-bond portfolio may carry a lot of risk if it’s over-weighted in cyclical sectors like energy and technology. Conversely, a stock portfolio almost entirely in consumer staples and utility stocks might be much less risky than you imagine.

Once you know your overall allocation to the different asset classes and within the different sectors, you can start to see gaps in your retirement plan and where your 401K investments might fit. If the gaps are fairly small, i.e. you should be investing more in bonds and other real assets, then you can use your 401K contributions to round out your total wealth.

I’ve talked to more than a few investors that found out they were grossly missing their retirement goals because they were way over- or under-allocated in an asset class and didn’t know it until looking closer at their investments. When this happens, using your 401K investments may not be enough to close the gap and you might need to adjust the investments in your other portfolios.

Don’t forget an investment in real assets like gold and silver as part of your investment plan. Most 401K plan investments don’t offer much of a choice in these critical assets so you’ll need to buy them in your individual retirement account (IRA) or as part of your other investment account. If your 401K plan is the majority of your investment planning, you’re likely not holding enough of these inflation-protected assets.