Pension plans are about to get too expensive for Corporate America. What comes next will shock you.

Corporate pension plans have been slowly bleeding out for 30 years but the new federal budget has just fired the final shot that will kill the system. New premiums make the costs of offering pension benefits to employees unmanageable and the fallout could start as early as next year.

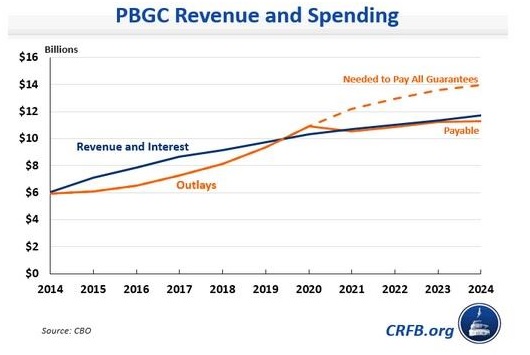

The problem is that it’s all going to happen just as the government’s own guarantor of pension benefits approaches insolvency. Anyone with retirement assets left in the system could suffer massive losses in promised benefits.

Pension Premiums Skyrocket 310% and Become Unmanageable

The government’s newly passed budget calls for a 22% hike in employer premiums paid to the Pension Benefit Guaranty Corporation (PBGC) through 2019. That adds another $14 in cost for every employee on top of the 236% increase in per employee costs added since 2005. Put it all together and pension costs will have risen 310% over just 14 years.

Alan Glickstein, senior retirement consultant at Towers Watson, calls it ironic that the increase meant to shore up the PBGC could end up weakening it through companies cutting head count in pension plans.

Ironic? I call it catastrophic.

The PBGC admitted last year in a report that it was “more likely than not” to run out of funds by 2022 and was 90% likely to run out by 2025. The government entity provides insurance guarantees to more than 44 million people in private defined-benefit pension plans.

Companies are already looking for ways to cut employees from their pensions including lump sum payouts that could lead to a huge tax bill and a 10% penalty if the funds are not rolled over quickly. New premium increases could lead to more companies simply terminating their plans with the burden falling on the PBGC. Employers do not even need to file for bankruptcy protection to pass pension responsibilities off to the PBGC under a distressed termination.

When that happens, the amount of benefits employees receive from the PBGC varies but no worker will receive more than 82% of their promised benefit and most receive much less. PBGC benefits for multi-employer plans are capped at $12,870 per year for new retirees with 30 years of service and will almost surely be reduced if the government fund gets into trouble.

Take Control of Your Money and Protect Your Assets

The 2006 Pension Protection Act (PPA) rolled back a lot of investor protection in employer 401k programs. The PPA repealed the ban on affiliated advisor fees as well as a giving employers the right to automatically enroll employees and protection against any liability of losses.

While the new premium increases put defined-benefit plans in serious jeopardy of failure, the PPA gives employers an incentive to manipulate defined-contribution plans for their own gain.

The only solution is to take control of your own money. Retirement assets held in a former employer’s plan must be rolled over into an individual retirement account to avoid the potential collapse in pension benefits. Putting assets into an account you control is the only way to be certain those assets will be there when you retire.

Rolling over your 401k plan to an individual account not only gives you control of your assets but you get greater freedom through more investment choices like real estate and precious metals besides traditional stocks, bonds and CDs.