Silver often gets overlooked by the average investor as gold is often considered a safer investment. The truth is that investing in silver in 2021 may be a smart decision.

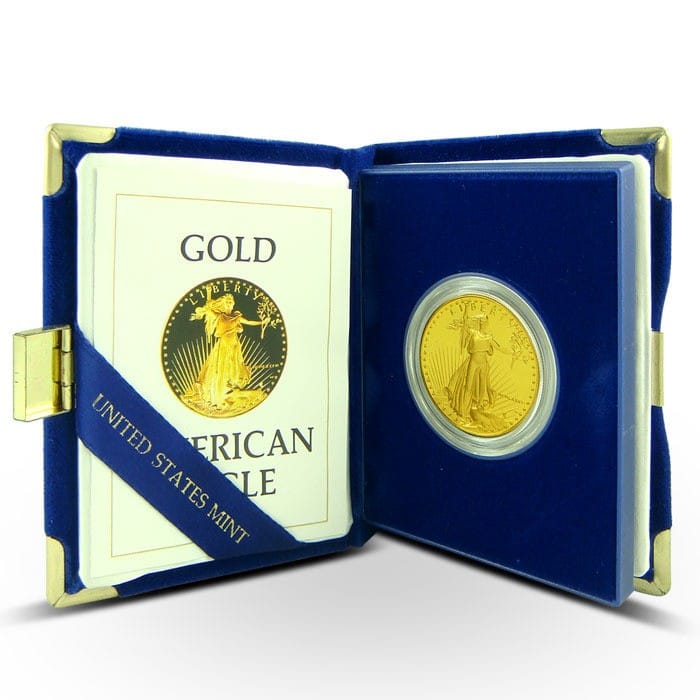

What Is The American Eagle Proof Coin Fair Market Value In 2020?

The American Eagle coin is the most popular coin in the world. The proof version of this coin is also an extremely popular collector version that is prized by savvy IRA and 401k investors. The reason this coinage is so popular is because it is sold directly by the US mint. Collectors coins are believed […]

7 Things to Consider When Choosing a New IRA Custodian.

Have you recently retired or changed employers? Have you been thinking about rolling over your inactive 401k, 403B or pension plan to an IRA… because you’ll have a much greater selection of investments? Well, choosing the “right” custodian is imperative… because they’re responsible for reporting the value of your account to the IRS every year. […]

Older Americans Now Work Longer

A Pew Research analysis of the Bureau of Labor Statistics’ 2016 employment data found that older Americans are staying in the labor force, and they are working longer hours. During the second fiscal quarter of 2016, nearly 19 percent of Americans aged 65 years or older reported that they were employed with either a full-time […]

U.S. Government Wasted $251M on Medicare in 1½ Years

According to the Inspector General for Medicare, Medicare Part B spending could have been lowered 35% (saving $251 million) if prices for drugs like milrinone lactate and Hizentra had been updated to current standards instead of being based on decades-old, patent-protected prices. Additionally, drugs that are used to treat life-threatening conditions such as cancer, diabetes, […]

⅓ of Households Not Ready For Retirement

According to a recent study by the Employee Benefit Research Institute, ⅓ of U.S. residents aged 30 to 59 will not have enough money to retire, even if they work until they turn 70 years old. If you are a responsible saver who wants to enjoy your golden years, Like and Share this post.

Government Accountability Office Lists Citizen Information Stored Online as “High Risk”

The Government Accountability Office (GAO) has announced that the personal information of U.S. citizens stored online has a “high risk” of being hacked into for purposes ranging from identity theft to extortion. The Cyber Security of Federal Information Systems collects, maintains and shares such information among government agencies, and the GAO believes that the ineffective […]

IRS Listed on Government Accountability Office’s “High Risk” List

The Government Accountability Office (GAO) is responsible for keeping government spending and waste in check for the good of U.S. citizens, and the GAO has listed the IRS on their “high risk” list each year since 1990. This year, the IRS made the list for its ability to enforce our nation’s tax laws correctly. The […]

2016 Budget Proposal Could Close Roth IRA Savings Loophole

A CPA and IRA consultant from New York uncovered a proposal in President Obama’s 2016 budget plan that would severely limit investors’ ability to save using company 401k plans as well as Roth IRAs. Current laws allow savers to make after-tax contributions to Traditional IRA plans and then convert those Traditional IRAs into Roth IRAs. […]

2016 Budget Proposal Could Mean Higher 401k Taxes

President Obama’s proposed budget for fiscal year 2016 includes measures that would increase the capital gains tax on profitable investments to 28%. Obama also wants to put a cap on tax-advantaged retirement accounts like 401k and IRA plans. What’s more, he wants to introduce the Buffett Rule, which requires a 30% minimum federal tax rate […]