Use these points to decide your 401k asset allocation and where to put your 401k money

The old rule for investing and asset allocation used to be to subtract your age from 100 for the percentage of your portfolio you should keep in stocks, putting the rest in bonds. The misguided advice has caused millions to miss their retirement goals and misallocate their 401k money.

Besides the fact that Americans are living longer, making the 100 rule obsolete, the rule is an oversimplification that misses out on some very important points.

How Much Do you Need and at What Risk?

A better start to retirement planning begins with an estimate of how much you will need in retirement. You don’t have to be accurate down to the penny but should try to estimate your living expenses to the nearest $50,000 or so. Take your current expenses, deducting those that you won’t have in retirement like education and retirement savings, and then add in new expenses for things like travel. The Department of Labor Consumer Expenditure survey can help you see how much people spend on average according to their age.

Any retirement calculator will show you the return needed on your investments to meet your future spending needs; given things like age, annual savings and current investments. Your next step is to do a reality check on this number.

If you need a return of more than 10% annually on your investments to meet your retirement goals, you may need to rethink your savings rate or your goals. Aiming for such a high annual rate will force you into riskier investments and may cause you to panic-sell when the markets tumble. A return of between 4% and 6% for a blended portfolio of different assets is a more realistic goal.

Your own tolerance for risk will also play a part in your 401k investing plan. There’s nothing wrong with being a conservative investor, preferring stability to the possibility of higher returns. The biggest mistake you could make is chasing returns to the point that market volatility makes you nervous and leads you to commit bad investing behaviors.

Best Investments for your 401k Money

Alas, the intent of the saying is still one of the best pieces of investing advice even if the analogy doesn’t quite work. You need to diversify your 401k investments across several different asset classes and within each asset class or risk putting your retirement in jeopardy.

Stocks are the naïve favorite of 401k plans, mostly because they get the most attention from the media and from advisors. Be wary of your 401k advisor and their recommendation for stock funds. These funds normally charge a higher management fee and the advisor may be getting a bigger commission to recommend them. Since you are more limited to your investment choices in most 401k plans and stock funds carry higher fees, it might be smarter to hold less stocks in your 401k compared to other assets. You can carry a larger weight to stocks in your self-directed IRA accounts or other investing accounts to balance out your portfolio while benefitting from the widest selection of investments.

Bonds and bond funds are also a popular 401k allocation choice but you might have more invested than you think. Advisors have been pushing target-date funds recently, mostly because they pay higher fees, and many of these carry large weightings in bonds. There is nothing wrong with holding a large percentage of your portfolio in bonds, it’s absolutely necessary for older investors, but make sure you know how much you have invested across all your bond- and target-date funds.

Precious Metals are an essential but too often neglected component of 401k and retirement investing. Investments in gold and silver have lost favor with investors since the frenzied prices of 2011 but still serve a critical importance to retirement plans. Precious metals provide one of the few real protections in a market dominated by financial assets. Unlike financial assets like stocks and bonds, precious metals are real assets that keep their value against inflation and will increase in value during periods of high market volatility. Beyond the fundamental need for safety, supply and demand are at turning points which may drive prices higher soon and make for very strong investment returns.

Even an allocation to riskier alternative investments like futures and private equity might have a place in your 401k plan. These investments may be higher risk by themselves but will still help to smooth the risk in an overall portfolio when combined with stocks, bonds and metals. You probably don’t want more than 5% or 10% of your 401k allocated to alternative investments but some allocation is important.

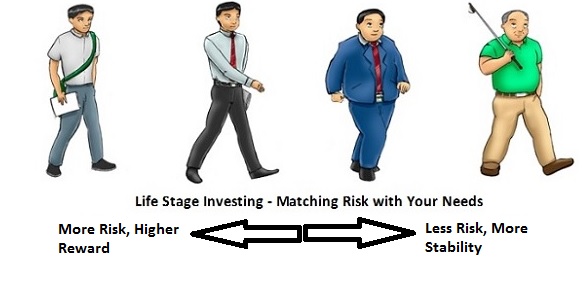

Will my 401k Investments Change as I get Older?

Probably the most important thing to remember about your 401k allocation is that it will change as you get older. That stock-heavy portfolio might be Ok for the new investor in their 20s but it will mean way too much risk for the 30- or 40-something investor.

There’s no rule to when you should shift your 401k allocations but most people revisit their strategy every ten years. This makes it easy to remember and avoids changing your allocation too often and paying too much in fees.

Don’t forget that your 401k allocation strategy should be as a part of your entire wealth strategy. It may be a separate account but your 401k money is still a part of your larger financial picture. If you have a large percentage of your regular investing account in risky assets, you might want to overweight your 401k investments to safer assets like bonds and precious metals. This will even out the risk in your overall wealth and prevent a market correction from wiping everything out.

Be sure to rollover those old 401k accounts from previous employers into individual retirement accounts for better flexibility and lower fees.