Benefits of an IRA vs a 401k

While most people are more familiar with a company-sponsored 401k, an Individual Retirement Account (IRA) is one of the most basic retirement savings tools. You can open an IRA with an investing firm or through your bank. You can make contributions to your IRA as long as you are working, but you cannot withdraw money from it without facing steep 401k withdrawal penalties until you are 59 ½. An IRA includes all the tax benefits of a 401k plan but also provides the benefit of control over your retirement investments. For investment options IRAs are the clear winner in the question of 401k vs IRA.

Basics of an IRA

- Contribution limit of $5500 each year or $6500 if you are over 50

- Can set up a Spousal IRA for a non-working spouse

- Wider array of options when it comes to choosing the types of investments you can include

- Contributions are tax-deductible when made and grow tax-free until withdrawal

With an IRA, you have more control over the types of 401k investments that you choose. Your 401k investments are normally restricted to a few mutual funds approved by your company, some of which might carry hefty fees and expenses. Some IRAs will allow you to invest in property, gold and other investments. You can also choose the investing firm or accounts that you choose to invest with, and even put the money into CDs (certificates of deposit) if you are a very conservative investor.

Benefits of a 401k vs IRA

A 401k is your retirement plan through your employer. You may also have a 403(b) plan if you work for a nonprofit or for a government agency. The rules for these two plans are very similar. If you are working, you can have your contributions to your 401k plan automatically deducted from your paycheck. There are a few advantages of a 401k vs IRA like higher contribution limits and employer matching.

Basics of a 401k vs IRA

- Contribution limit of $18,000 each year

- Choose from among plans offered by your employer

- Take advantage of employer matching contributions

- Contributions are tax-deductible in the year made and grow tax-free until withdrawal

The amount you can contribute to your 401k is larger than the amount you can contribute to your IRA investment options, which means that you will likely want to contribute to your 401k each year. Additionally, you may be able to take advantage of matching contributions that your employer makes that will increase your retirement savings at no cost to you. These benefits make using a 401k a good option when it comes to retirement planning. However, you are limited on the investment types that you can choose to the few accounts that the company offers through its plan.

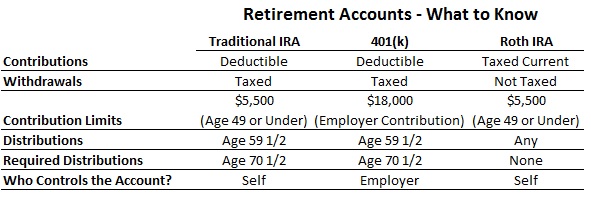

Traditional 401k vs IRA Roth Retirement Accounts

With both 401ks and IRAs, you have the option of choosing between a traditional and a Roth account. Not all employers will offer the option for a Roth account, but it is becoming more widely available. There are tax advantages to each account, and it is important to understand the differences before you choose which type of account you want to open. If you have both types of accounts, your total annual contributions cannot exceed the limits in the combined accounts each year. So you cannot have a traditional IRA and a Roth IRA and contribute more than a combined total of $5500 to the accounts.

Traditional Retirement Accounts

- The contributions you make on these accounts are tax deductible

- You will be taxed on your withdrawals

- You can lower your current tax bill, but will pay more in taxes on your withdrawals

Roth Retirement Accounts

- You will pay taxes on your contributions

- You will not be taxed on your withdrawals

- Over time you will pay less taxes, because you do not have to pay taxes on the earnings within the account

Choosing Between Roth and Traditional Accounts for your 401k vs IRA

Once you clearly understand the difference between the two types of accounts, you will be able to make a better decision regarding the type of account you want to open. You may choose to open a Roth IRA account and make monthly contributions, while contributing to a traditional 401k account through your employer. If you have the option of a Roth 401k rollover and you can afford to make the contributions, give this option serious consideration. It will lower your overall taxes over your lifetime, and give you more money when you are retired and not earning a lot of money. The different advantages and benefits to each account make it less a question of 401k vs IRA, but more a question of how to use both accounts together to meet your retirement goals.

401k vs IRA Basic Information

When Should I Rollover a 401k to an IRA?

The higher contribution limits to a 401k make it a good retirement savings tool. However, there are situations when rolling it over into an IRA makes sense. Every time you change jobs, you leave your 401k behind at with your former employer. They manage the funds for you, but you have little control over the investment. It can also be difficult to keep track of all of your 401k accounts, especially if you frequently change jobs. When you change jobs, it’s a good idea to roll your 401k into an IRA. This allows you to consolidate your retirement funds so they are in one place and easier to manage. It will also allow you to choose from a wider option of investment opportunities.

Finding a Good IRA

There are a number of different types of IRAs in which you can invest. It is important to find one that works well with your investing strategy and works well with the amount of risk that you are willing to take. Remember that as you get closer to retiring, you want to choose more conservative investments that will hold steady and not be affected by the fluctuating stock market.

- IRAs at Banks or Credit Unions: You may open your IRA at a bank or credit union. The money in these accounts will go into Certificates of Deposit (CD). This is a very conservative investment and often as the lowest rate of return possible. The FDIC will guarantee the money in these accounts up to $250,000.

- IRAs at Investment Firms: You can open an IRA at an investment firm that will manage the account for you. Usually the money in these accounts will go into mutual funds. You have the option to choose the amount of risk you want to take with these funds, and you can talk to your broker about changing the risk level, as you grow closer to retirement. However, you can only invest in the market with these IRAs.

- Self-Directed IRAs: This is the IRA that offers the most flexibility. You will need to find a firm that offers self-directed IRAs. In this type of IRA, you can purchase gold, property and other investments for your retirement. There are strict rules surrounding the transactions, and you need to follow them carefully. If you would like more freedom with your IRA and you understand investing and property investments, this may be a good option for you.

When you are ready to rollover your IRA, you will need to close out your 401k. You have 60 days from the time you withdraw your funds to open the IRA. If you fail to meet the deadline, you will have to pay the early withdrawal penalties and taxes on the money that you took out. You may want to begin the 401k rollover process of opening your IRA before you withdraw the money from your 401k. Whether you choose a bank, an investment firm, or a firm that offers self-directed IRAs, the account representative should be able to help you fill out the paperwork correctly so that you do not end up incurring any penalties when you complete the process.

Rollovers do not count toward your annual contribution limits for the year, and so you can rollover the entire amount of your 401k into the IRA. Once the IRA is open, you can determine how you want the money invested. If you are doing a self-directed IRA, you will begin to make the investments yourself. You should be issued a checkbook that allows you to purchase the investments as part of the IRA. You will need to take the time to review the paperwork and rules carefully as you make these purchases. You are not allowed to complete transactions (either buying or selling) with family members for your self-directed IRA. Additionally, if you plan on purchasing property as part of your investment, you cannot live there or stay there throughout the year. It cannot be a vacation home or a second home.

The process may seem more complicated than a simple question of 401k vs IRA but you stand a lot to gain by making the right choices. Fortunately, there are resources available to help you make the decision and to guide you through the process.

Rolling Over a Traditional 401k into a Roth IRA

When you rollover your 401k account, you do have the option of turning a traditional account into a Roth account. However, you will be responsible for paying the taxes on those contributions when you do the rollover. Depending on your current income bracket, it can get very pricey to do it that way. For this reason, many people choose to simply rollover a traditional 401k into a traditional IRA and then make the tax payments when they retire. You can also have a Roth IRA that you make monthly or annual contributions to in order to take advantage of the tax savings. To get started and discover how easy it is to flex your financial muscle with a 401k rollover, contact us today. Effective as of January, 2015